Auto Loan Payment and Interest Calculator. Your monthly auto loan payment is determined by several key factors: the car price, down payment, loan term, and interest rate, which is significantly influenced by your credit score. It’s important to note that interest rates for used car loans are typically higher than those for new car loans. Utilize the inputs below to estimate your potential monthly auto loan payment accurately.

Auto Loan Payment and Interest Calculator

Car Loan Calculator

Monthly Payment:

Total Paid:

Looking to purchase a new or used car? Use our comprehensive car loan calculator to estimate your monthly payment and total interest over the term of your loan. This tool will help you make informed financial decisions and manage your car loan effectively.

Key Takesaways

- Financing Options: Many individuals opt for an auto loan to fund their car purchase, whether through a dealership or a financial institution.

- Payment Factors: Your monthly auto loan payments are influenced by several key factors, including the vehicle’s price (new or used), the amount of your down payment, the loan term, and your credit score.

- Preparation Tips: Utilize an auto loan interest calculator before visiting the dealership to ensure you are prepared to select a vehicle within your budget and to negotiate the most favorable terms.

Understanding Auto Loan Payment Calculator Results

To utilize the car loan interest calculator effectively, input the following details:

- Vehicle Cost: This represents the total amount you plan to finance for purchasing the car. Subtract any down payment or trade-in value from the vehicle’s price to determine the actual loan amount.

- Term: This refers to the duration over which you will repay the loan. A longer term results in lower monthly payments but increases the total interest paid. Conversely, a shorter term leads to higher monthly payments but reduces the overall interest expense.

- New/Used: Indicate whether the vehicle is new or used. If the interest rate is unknown, this input helps estimate the rate, noting that used cars generally attract higher interest rates.

- Interest Rate: This is the cost of borrowing, expressed as a percentage of the loan amount.

Once these details are entered, the calculator will automatically provide the following results:

- Total Monthly Payment: The amount you will pay each month throughout the loan term, which includes a portion that goes toward reducing the principal and a portion that covers interest.

- Total Principal Paid: The total sum borrowed to purchase the car.

- Total Interest Paid: The cumulative interest expense over the life of the loan. Generally, the longer the repayment period, the higher the total interest paid. To determine the overall cost of the car, add the total principal paid to the total interest paid.

How Interest is Calculated on a Car Loan

An auto loan interest calculator provides insight into the total interest you will pay over the duration of the loan. If the calculator includes an amortization schedule, it will detail the interest portion of each monthly payment. Typically, with car loans, each payment is split between reducing the principal (the borrowed amount) and covering the interest.

Interest charges are calculated based on the outstanding loan balance. At the beginning of the loan term, when the balance is higher, the interest component of each payment is greater. As you make payments and reduce the principal, the interest portion of your payments gradually decreases.

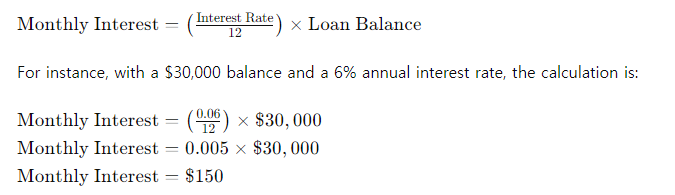

To calculate the interest on your car loan manually, you can use the following formula:

To convert an annual interest rate percentage to a decimal, divide by 100. For example, 6% becomes 0.06 (6 ÷ 100 = 0.06).

How to Calculate Your Car Payment

Our loan calculator provides a clear picture of your monthly car loan payment and the total interest you will incur over the life of the loan. It is an invaluable tool for exploring various loan scenarios to find one that fits your budget and aligns with your acceptable level of total interest.

To manually calculate your monthly car payment, follow these steps:

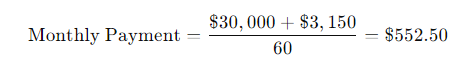

- Determine the Total Cost: Add the total loan amount to the total interest charged. For instance, on a $30,000 loan with a 60-month term at a 4% interest rate, the total interest would be $3,150.

- Calculate the Monthly Payment: Divide the sum of the loan amount and total interest by the number of months in the loan term. In this case, the calculation is:

Keep in mind that extending the loan term results in higher overall interest costs and may also increase your interest rate. To minimize interest payments, make a down payment if possible and choose the shortest loan term that fits within your budget. Additionally, remember to account for other car-related expenses, such as insurance, fuel, parking, and maintenance, to ensure you can comfortably manage all aspects of car ownership.

Is a 72-Month Car Loan a Good Choice?

While a 72-month car loan may offer lower monthly payments compared to a shorter-term loan, it comes with potential drawbacks. Extended loan terms generally result in higher total interest costs over the life of the loan. Additionally, due to the depreciation of vehicles, a longer loan term increases the risk of being “upside-down,” where the car’s value falls below the outstanding loan balance. In a rising interest rate environment, shorter loan terms may also be more advantageous to avoid higher overall interest costs.

Can You Negotiate the APR for a Car Loan?

Negotiating the Annual Percentage Rate (APR) for your car loan is possible, depending on the lender and your creditworthiness. Dealerships that offer in-house financing may have more flexibility to adjust interest rates to finalize a deal. Since lenders are not obligated to provide their best available rate, effective negotiation can potentially save you hundreds or even thousands of dollars over the loan’s term.

Why Do Dealers Prefer You to Finance Through Them?

Dealers often prefer buyers to finance through them because it can be profitable. They may earn income from the interest paid on the loan and may also receive commissions or origination fees. This financial incentive can make dealership financing an attractive option for them.

The Bottom Line

Using an auto loan interest calculator can provide valuable insights into how different interest rates impact your monthly payments and total interest costs. These calculators also allow you to compare various rates for the same loan amount, helping you make more informed decisions and potentially save money by securing a lower interest rate.